Millennials and credit card rewards fans rejoice! The NEW American Express Cobalt Card has arrived in Canada ready to shake up the way we earn and redeem our rewards points.

There’s a lot to unpack with this card, so let’s get right to it. The Cobalt Card was designed by millennials for millennials, but as you’ll see it will have much broader appeal for those who want to maximize the rewards earned on their everyday spending.

Earning Points

Who doesn’t like to eat and drink? With the Cobalt Card, not only can you earn 5x the points for every dollar spent on groceries, you can also earn 5x the points for every dollar spent at restaurants, bars, and on food delivery.

With no limit to how much you can earn in the ‘eats and drinks’ category, Cobalt is the only card on the market that pays out 5x the points year-round on groceries, dining, and take-out.

Cobalt also highlights ‘travel and transit’ categories by paying out 2x the points for every dollar spent on travel, gas, and public transportation.

Finally, you’ll earn one Membership Rewards point on all other purchases, including those retailers coded as ‘general merchandise’.

Welcome Bonus and Annual Monthly Fee

One of the more intriguing features of the new Cobalt Card is the unique structure of its welcome bonus and monthly fee. Yes, I said monthly fee.

You see, one aspect of the millennial lifestyle is this comfort with a low monthly fee subscription format. So, with the Cobalt Card, you’ll pay a $10 monthly fee as opposed to a typical $120 annual fee paid upfront.

Does this monthly format impact how the very generous 40,000 Membership Rewards welcome bonus gets paid out? You bet! Here’s how it works:

In your first year as a new Cobalt Cardmember, you can earn 2,500 Membership Rewards points for each monthly billing period in which you spend $500 in purchases on your Card. This could add up to 30,000 points in a year.

On top of that, if you sign up by January 30th, 2018, you can earn an additional 10,000 Membership Rewards points bonus if you make a total of $3,000 in purchases in the first three months.

So, in the first year a new Cobalt Cardmember can earn a welcome bonus of up to 40,000 Membership Rewards points. That’s enough for a long-haul flight to almost anywhere in Canada or the continental U.S., $400 in statement credits redeemed towards travel purchases charged to your card, or $400 worth of tickets at Ticketmaster.ca.

Redeeming Points

That leads us to the wide variety of ways that Cobalt Cardmembers can redeem their points. First up, the Fixed Points Travel Program:

Redeem the fixed points amount towards the base ticket price, which is the cost of the flight excluding taxes, fees, and carrier surcharges. You can also use your Membership Rewards points to pay for taxes, fees and other surcharges.

The Fixed Points Travel Program will only be available if you have enough Membership Rewards points to cover all travelers at the fixed points amount.

You can also redeem Membership Rewards points for a statement credit towards eligible travel purchases starting at 1,000 points = $10 statement credit. Other non-travel purchases can also be ‘credited’ from your statement, but at a lower value of 1,000 points = $7 statement credit.

Ticketmaster purchases charged to your Cobalt Card can be credited off starting at 2,000 points = $20 statement credit.

For the Amazon.ca shoppers, you can also redeem Membership Rewards points towards eligible items at Amazon.ca through the ‘Shop with Points’ program. To do so you mist first link your Membership Rewards program account with your Amazon.ca account.

Final thoughts on the NEW Cobalt Card

American Express has reset the top of the rewards card market with its new Cobalt Card. Simply put, 5x the points on groceries and dining is best in class, and when you factor in 2x the points on travel, gas, and transportation, the Cobalt Card easily ranks as one of the top rewards cards in Canada for everyday spending.

The high earn rate aside, all the points in the world aren’t useful unless you can redeem them when you want, how you want, and for what you want. Cobalt’s wide-variety of ways to redeem points means Cardmembers don’t have to just save up for a flight – points can be redeemed for statement credits, concert tickets, Amazon.ca purchases, and more.

This is definitely a card I’ll be adding to my wallet. Learn more about this card here.

Last month I applied for the Starwood Preferred Guest Credit Card from American Express. This card recently, and for a limited time, increased its sign-up bonus from 20,000 Starpoints to 25,000 (offer expires October 18, 2017). Thanks to the heads-up from Patrick at Rewards Canada, I learned about the limited time offer and also that you can convert Starpoints to Aeroplan miles and earn a juicy bonus for your efforts.

Indeed, you’ll get an extra 5,000 points when you transfer 20,000 Starpoints directly to miles with your frequent flyer program – in my case I converted Starpoints into Aeroplan miles. But here’s the kicker: Aeroplan is currently running a promotion until August 21 that offers a 35 percent bonus when you convert hotel points into Aeroplan miles. One of their hotel partners is SPG.

That means if I played my cards right I could take my 25,000 Starpoints credit card bonus and turn those points into 40,500 Aeroplan miles. Here’s how it worked out:

Applying for and using the SPG American Express Card

Applying for the SPG American Express card was straightforward and painless, but to get the 25,000 point bonus I’d have to spend $1,500 within the first three months. In fact, I’d have to reach the $1,500 threshold within the first billing cycle to trigger the 25,000 point bonus in time to take advantage of the Aeroplan hotel point conversion offer.

I thought this would be fairly easy, but American Express cards are not as widely accepted at grocery stores and restaurants, and certainly not in some of the small B.C. towns in which we were vacationing this summer. Lo-and-behold, when we got back home and checked the mail, I found the answer to my prayers: our house insurance was up for renewal. We pay it upfront – $1,300 for the year – and get a 3 percent discount. Problem solved.

A few days later my first credit card statement became available and just a few days after that the 25,000 sign-up bonus was posted to my SPG account. Winner-winner!

Converting Starpoints to Aeroplan Miles

Springing into action (points were posted on Wednesday Aug 16) I logged-in to my SPG account, clicked ‘Redeem Starpoints’, found the ‘Transfer to Air Miles’ banner, and located ‘Aeroplan’ from a long list of airline partners and frequent flyer programs.

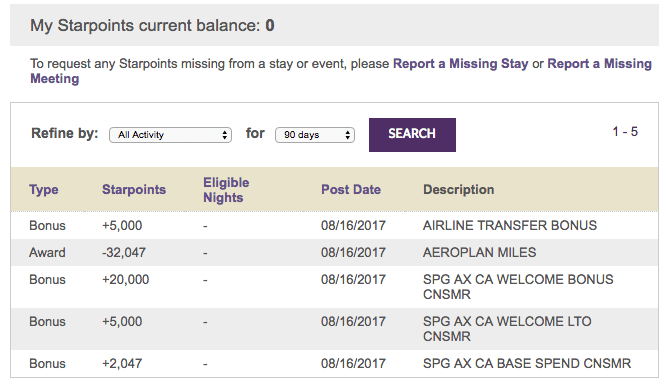

I was able to transfer all of my points – 27,047 to be exact – and earned the 5,000 airline transfer bonus.

Altogether I sent 32,047 Starpoints over to my Aeroplan account. When Aeroplan applies the 35 percent bonus for converting hotel points into Aeroplan, I’ll see a total of 43,263 Aeroplan miles land in my account.

Related: Experts reveal the best way to redeem 50,000+ Aeroplan miles

Now that’s some serious travel point hacking!

Final thoughts

My latest travel point hacking expedition was a big success. Sure, the SPG American Express card comes with a $120 annual fee, but if you consider that 1 Aeroplan mile is worth approximately 2.5 cents then my newly found 43,000+ Aeroplan miles is worth more than $1,000 in flight rewards.

Heck, even if you conservatively value 1 Aeroplan mile at 1.5 cents then this was still a highly profitable venture worth nearly $650.

So that’s great for me, you say, but what about you, the reader? Well, you can still apply for the Starwood Preferred Guest Card from American Express until October 18, 2017 and earn 25,000 Starpoints after spending $1,500 within the first three months. You can still convert those Starpoints to Aeroplan miles and earn an extra 5,000 points for a total of 30,000 points.

30,000 Aeroplan miles is worth $450 on the low-end and $750 on average in flight rewards. Still worth it!