How Costco Throws A Wrench In Your Rewards

As an Executive Member I get 2% back on nearly every purchase made at Costco. The good news: I received a reward coupon in the mail from Costco for $176.61. The bad news? It means that I spent $8,825.50 – or $735 per month – at Costco this year.

I included this amount in my budget under “rewards earned” even though it has no cash value and can only be redeemed at Costco locations. It also got me thinking about how shopping at Costco can throw a wrench into your calculations when determining the best rewards credit card.

Related: Why Costco’s Executive Membership is worth the fee

You see, all of the online rewards card calculators use general categories such as groceries, gas, and dining to help you identify the card that gives you the best bang for your buck based on your personal spending habits. Rewards cards that pay a higher earning rate on grocery purchases, like the Scotia Momentum Visa Infinite or Scotiabank Gold American Express Card, come out ahead for individuals and families who spend a lot on food.

The Costco effect on rewards calculations

But if you’re like me, and do the majority of your grocery shopping at Costco, you can throw that calculation out the window because:

- Costco does not accept Visa or American Express cards, and;

- Costco is not categorized as a “grocery” merchant – it falls under “department store” or “other”

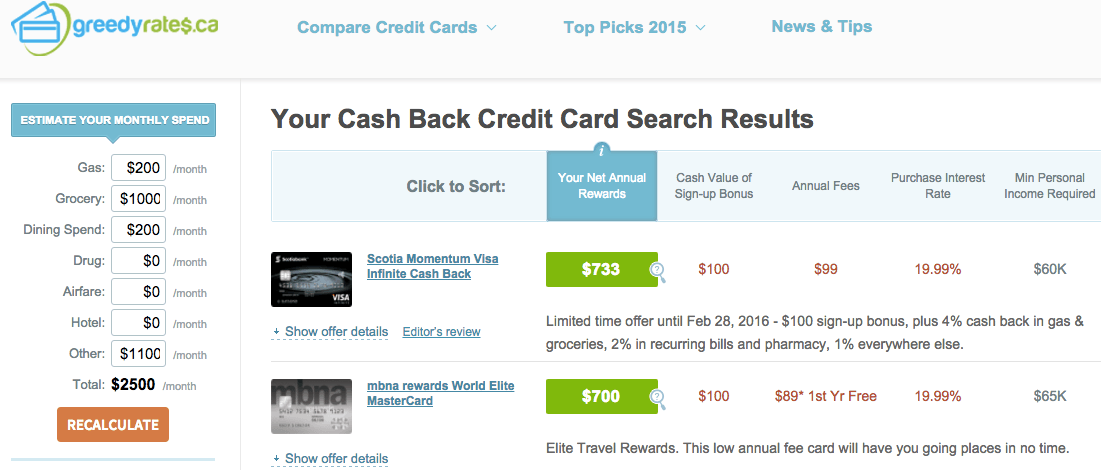

When I post my typical grocery-heavy monthly spend in the GreedyRates calculator it recommends the Scotia Momentum Visa Infinite card as the best option:

Note the monthly spending breakdown on the left. I entered $1,000 under ‘groceries’ to reflect our overall household spend in that category. But remember that Costco purchases aren’t eligible for the 4% category bonus that the Scotia Momentum Visa Infinite offers because Costco stores have a different merchant code than other grocery stores.

Now watch what happens when I move my $735 monthly Costco spend from the grocery category to ‘other’:

The Scotia Momentum Visa Infinite card slides all the way down to fifth place – losing $265 cash back in the process. In fact the numbers are worse for the Momentum Visa because Costco doesn’t accept Visa cards! We have to take out my $735 per month spend completely, which drops the Scotia card to just $380 cash back per year.

The cash back rewards king for a Costco shopping household like mine is the mbna rewards World Elite MasterCard. That’s because it pays 2% back on every purchase, regardless of the category, and including Costco purchases.

Also in the conversation is Capital One’s Aspire Travel World Elite MasterCard; the rewards card that I use for my Costco spending. It also pays 2% back on every purchase and its new redemption system means that you can get a statement credit and make partial redemptions on travel purchases.

Final thoughts

While the Scotia Momentum Visa Infinite card reigns supreme for cash back rewards fans due to its 4%/2%/1% rewards structure, a good argument can be made for Costco shoppers to ditch the Visa altogether in favour of a MasterCard that pays 2% on every purchase.

That’s the situation I find myself in as the annual fee on my Momentum Visa comes due in the new year. As our family shifts more-and-more of our grocery spending to Costco, it makes little sense to carry two everyday annual fee cards.

Readers: Does the Costco effect influence your choice of rewards cards?

Hi Robb. Thanks for the article. I also have struggled with the same issue. One solution I am looking at is to do all gas & grocery shopping at a local retail Co-op store. I am not sure if you are aware that most successful Co-op stores issue their own cashback rewards as yearly dividends sometimes as much as 5% per year. Add this to the Scotia Visa 4% reward and you start getting fairly competitive with the Costco options. Our local store also is a licenced liquor vendor so we get the same rewards for our wine and liquor purchases!! Some food for thought…

Hi Garth, thanks for your comment. I’m glad you brought it up because I actually wrote about using the Scotia Visa + Co-op gas combo a few months ago – https://rewardscardscanada.com/how-i-get-11-5-cash-back-on-gas-purchases/

Co-op is a lot closer to my house than Costco and so although we do the majority of our grocery shopping at Costco now, it’s more convenient to fill up at Co-op. Our location has a liquor store as well, which is also handy!

Sorry, I should also point out that our Co-op location is just gas and liquor, no groceries.

Thanks for the link Robb.

The other thing I find by buying at the Co-op, is that I come home with a lot less of those items which were “not on the list”. Costco has a devious marketing department working behind the scenes…